Hobart TAS

Hobart TAS

Home Finance Centres of Australia Hobart11 years11 years

Home Finance Centres of Australia Hobart11 years11 years

Mortgage News

Winter 2013 1. Beating the low doc blues 2. Looking beyond the bright lights 3. Cosy shouldn't mean costly 4. Try before you buy: secrets of pre-purchase inspections 5. Economic wrap

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsPlan Ahead

Home Finance Centres of Australia (Hobart) has available, our Homebuyers guide, Your Home Your Mortgage.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsBorrowing Within Your Means

While your lender will give you a maximum borrowing amount, it’s essential that you determine your own borrowing capacity when searching for your new home.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsEditorial: Reserve Bank Interest Rate Increases and Property Investments

In this issue of Mortgage News looks at managing your mortgage in a rising rate environment, detailing a number of tried and tested strategies.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsAutumn Newsletter Released - Investment Property Purchasing

We discuss some investment property options, renovation for home sale and helping your kids buy their home, in view of recent cash rate increases.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsInterest Rates and Your Mortgage

With uncertainty surrounding interest rate movements there has never been a more compelling reason to consider the impact rates have on your mortgage.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsCapitalise on Government Incentives for First Home Buyers

For first time buyers, the good news is that the government has introduced a number of incentives to help you achieve home ownership sooner!

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 yearsHousing Prices In Australia

In recent times, some commentators have suggested that the Australian housing market is expensive, relative to household incomes. This has led the 'price to income ratio hawks' to suggest that a pricing correction is imminent.

Home Finance Centres of Australia Hobart12 years12 years

Home Finance Centres of Australia Hobart12 years12 years

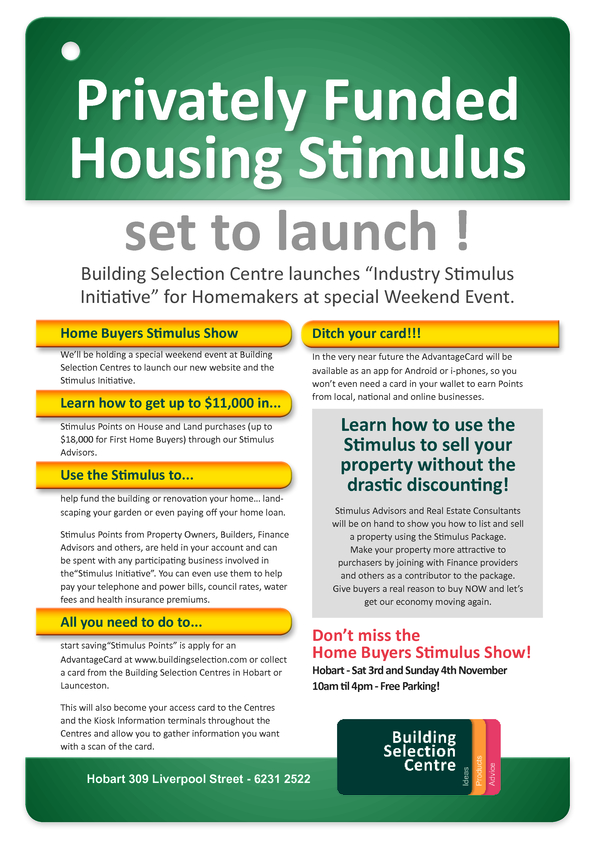

Looking for ways to build a new home in Hobart

Come to the Building Selection Centre this week end and talk to land agents, Builders, Mortgage experts. Find out how the Building Stimulus package can help

Home Finance Centres of Australia Hobart13 years13 years

Home Finance Centres of Australia Hobart13 years13 yearsCan You Save By Refinancing?

If you have a CBA standard variable loan the rate has just increased to 7.81% plus on going fees means the comparison rate (real cost) is 7.94%. Payment on a loan of $249,000 is $1802 per mth. (including $8 mth fee)

Home Finance Centres of Australia Hobart13 years13 years

Home Finance Centres of Australia Hobart13 years13 yearsRent Trap Looms For First-Time Buyers

"While the general economic situation is strong, the expectation of increasing cash rates will be a continuing negative factor on confidence," he added. "However, if rates stay on hold for the next six months, confidence is likely to grow.&

Would your home be secure if you were unable to work?

With your loan in place, it is worthwhile considering the importance of personal risk protection.

Life’s full of unforeseen events such as, serious illnesses which could prevent you from working (cancer, heart attack) or death or permanent disablement. These types of events could seriously affect your ability to meet your financial commitments.

Whilst little can be done to avoid the emotional trauma that will inevitably occur, proper planning can minimise the financial consequences and help safeguard you, your family and your home.

People will always cope better with the emotional trauma when they are able to avoid any added financial concerns.

Personal risk protection (such as income protection, life insurance, trauma cover, total and permanent disablement) ensures that you and your family are adequately covered in the case of life’s unforeseen events.

I am pleased to announce Allan Faint & HFCA (Hobart) has developed a strategic alliance with Lifebroker, ALI Group and GDA Group, who can assist you with all your personal risk protection needs.

Similar to the home loan process where we compared 100’s of loan products from Australia’s leading lenders to find the loan best suited to your needs, I can arrange for you to be able to compare, at no cost to you 100’s of personal risk products from Australia’s leading risk providers. Saving you time and money.

It couldn’t be simpler. At your request you will be contacted by phone and then based on the information you provide and the type and amount of cover requested you will be provided with a report detailing the most competitive cover from their panels of providers (which include AMP, Comminsure, Tower, Zurich, Aviva, ING, MLC, Metlife, Macquarie, AXA, Suncorp, AIA and Asteron).

If you already have a personal risk policy in place, it might be a good opportunity to compare your current policy with a wide range of other products to ensure that you are still getting the best value for your money.

To find out more about how to compare Australia’s leading life insurance companies at one time, give me a call or email me.

Regards,

Allan Faint